I am delighted to be back in India for the next month, meeting with clients and industry leaders while spending time travelling and seeing my family.

When I return to India, I am often reminded how crucial fintech is in improving everyday lives and providing access to financial products, among other things.

One of the best methods of this, in my opinion, is embedded finance.

In a nutshell, embedded finance places financial products into non-financial apps or websites, in order to streamline the user experience and reach the customers where they already are. Embedded payments within apps like DiDi and WeChat, and buy-now-pay-later providers are among the most adopted examples.

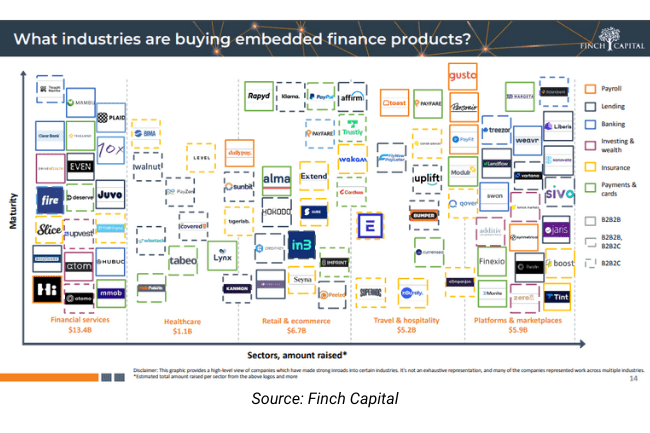

Here are some use cases of embedded finance globally:

E-Commerce

Embedded payments has been the norm for a while now, and other financial products are following suit. When users buy an expensive product online such as electronics, insurance could be added immediately or credit for the purchase.

E-Commerce businesses such as Blinkit (India), Lazada (Singapore), and Zalora (Singapore) have started to implement account wallets and integrated payments that create a streamlined experience for customers.

Health Tech

For the private healthcare market, financial products such as payments and wealth management can be embedded into the user journey, providing patients with better transparency around the cost of their healthcare.

Payzen (USA) is an operating system that aligns healthcare providers with the affordability of their patients, so patients can access their healthcare through a payment plan. This innovative approach will help many patients, particularly in private-led healthcare systems such as the US, to access the care they need without risking their finances.

Travel

Travelling is a large financial expense through the payment of tickets, hotels, transport, insurance, currency exchange, and healthcare. Embedded finance provides travel companies with an opportunity to be a single shopfront for all a user’s travel needs.

Travel app Hopper (Canada) launched fintech products such as price freezes and flight protection in order to make money, but has since found it is a core part of their value proposition. As a frequent traveller, I am excited to see how Hopper and other’s solutions improve the experience of travelling for business and leisure.

Entertainment

The entertainment industry across film and TV, music and gaming has many use cases attached. From linking artists to relevant products or integrating crypto purchases within a game, businesses are making existing payments far easier for users.

Checkout.com (UK), among servicing other industries, enables gaming companies to embed payment technology that caters for the players’ market and tokenizes the transaction, ensuring purchases are seamless and secure.

Superapps

The superapp label refers to a platform that offers multiple services in the same space. Indian fintech PhonePe is establishing itself as a financial superapp, adding insurance, investments, and lending to its original digital wallet offering. The popularity of superapps, particularly in APAC, demonstrate the current trend of ‘rebundling’ services and the theory of seamlessness behind embedded finance.

The global embedded finance market is expected to surpass EUR 6 trillion by 2025, with consumer retail as the leading embedder in non-financial industries, ahead of telecoms and healthcare. Almost every product and business has some financial transaction attached, and embedded finance is all about making that as easy as possible for the user.

These use cases are creating seamless experiences for customers in lots of industries, and I look forward to seeing other innovative ways brands are using embedded finance to service customers.

Email hello@smitagupta.com for enquiries.