If you are the CEO of a fast-growing fintech company, what I’m going to share next will resonate with you.

With the uncertain macro-economic and socio-political environment, you need to think about new models of value creation through sustained and relevant growth.

Having read McKinsey’s report, Fintechs: A New Paradigm of Growth, it struck me how the approach of fintech companies is changing. The shift from building the latest cutting-edge tech and waiting for customers to come, to gradually building a product based on market fit, fintechs are taking their time to grow.

Fintech investment has been up and down in the last few years. 2021 saw an unprecedented spike in fintech investment with 177% YOY growth, before dropping back down in 2022.

The time between investment rounds has increased and the amount per round has decreased, meaning fintechs are adapting their business models to be sustainable and not rely on external funds. Let us look at the four core aspects of sustainable growth model:

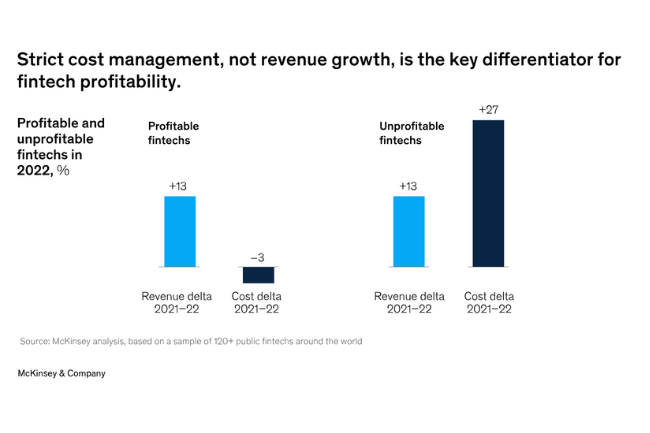

Cost Discipline

Cost management is more important than revenue growth when it comes to building a profitable business. Fintechs need to determine the right product market fit to ensure any spending will result in viable returns.

Businesses should also take a more holistic approach to business economics, comparing the customer lifetime value (LTV) to customer acquisition costs (CAC) to understand what the margins for spending are.

Measured Growth

These three steps enable businesses to grow sustainably.

First, they should build a strong core product or service within their home market. Going ‘back to basics’ mean businesses are 1.6 times more likely to generate competitive returns.

Second, businesses can expand into adjacent geographies or industries, once it makes sense to do so. This is no longer a ‘must-do’ though.

Finally, there’s the ‘shrink to grow’ plan. Rather than stick in markets that aren’t working, fintechs should reinvest in high-performing areas.

Building a steady and measured growth model helps ensure the foundations are in place before building up and out.

Programmatic M&A

New products, features and revenue streams are sometimes easier to buy than build. M&As increase and have better returns during times of economic uncertainty, but, of course, are not always successful.

Keeping the fintech culture alive

The main differentiators between fintechs and incumbents are fintechs’ agility, lack of legacy technology slowing them down, and innovation in tech and customer experience.

As the fintech industry implements agile operating models to prepare for technological advances and economic uncertainty, sustainable growth will be important to keep up with the market and stay afloat.

In a liquidity-constrained environment, fintechs and their investors are emphasising profitability, not just growth in customer adoption numbers of total revenues.

Get in touch if you’re looking for a growth advisor to support you on your journey.