I always enjoy returning to India, this time to enjoy Diwali, the festival of light and also taking the time to meet some really cool fintechs in India. It amazes me how much the industry has accelerated in the last five years.

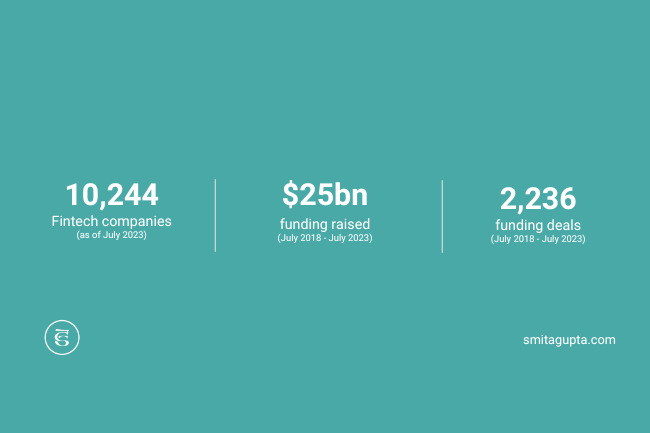

The market is growing rapidly, ranked third behind the USA and UK for number of fintech companies (10,244), the amount raised ($25bn) and number of deals in funding (2,236) between July 2018 and July 2023.

The market is focusing on three key themes:

- Sustainable Profitability – Building and scaling fintech businesses for longevity

- Governance – Putting regulatory compliance at the forefront of fintech governance

- Collaboration – Driving value through working with incumbents

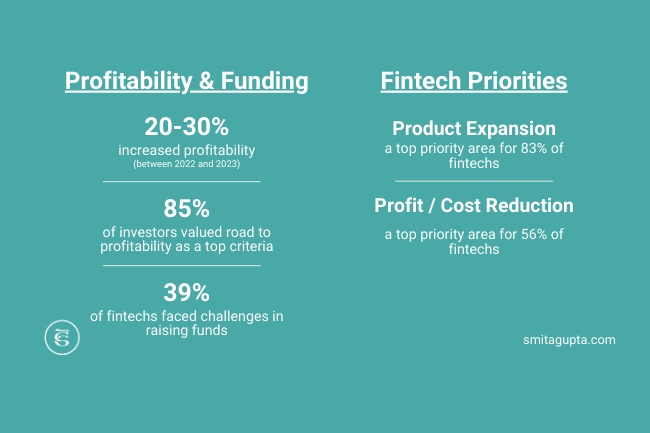

The profitability of fintech companies in India has increased by 20-30% in the last year, supposedly due to increased focus on governance and pressure from regulatory bodies.

CEOs of Indian fintech companies are spending the majority of their time on partnership discussions with incumbents, following the lead of other global players to collaborate across the financial services ecosystem – as I have highlighted in my previous posts “Collaboration is the key to innovation”.

Themes shaping the future of fintech in India are:

- Generative AI

- There has been a 44% increase in global gen AI fintech companies between 2016 and 2022. Use cases are focused on marketing and sales, product development, financial advice and customer support.

- Quantum Computing

- Internet of Things

- Block Chain

- API – Open Connectivity

Of course, it’s not all easy going. Although fintechs are increasing their profitability, a highly-valued metric for investors, 45% of early-mid stage and 32% of late-stage fintechs had difficulty securing funding this year.

Fintech companies in India are facing challenges, such as working with the legacy tech of incumbents, building consumer trust as a digital solution, and protecting themselves and customers from fraud.

By 2025 ,India is projected to have 900mn internet users, with the majority of new users being women from rural areas. The market is booming and will continue to do so as users adopt digital services and solutions are built that promote financial access and inclusivity.